The Goods and Services Tax (GST) Council’s decision to levy an 18 per cent tax on the sale of all old and used vehicles, including electric vehicles, has taken the nation by storm. Though the revised tax rate does not apply to persons not registered under GST, the decision taken at the 55th Meeting of the GST Council has become the talk of the town. But, why is the government keen on imposing higher taxes on used cars?

Petrol and diesel vehicles already attract the highest GST bracket. In fact, cars more than four metres in length, with 1,500cc engines and above, and greater than 170 mm of ground clearance attract a humongous 50 per cent tax — 28 per cent GST and 22 per cent cess, according to the Society of Indian Automobiles Manufacturers, a body representing major vehicle and vehicular engine manufacturers in India.

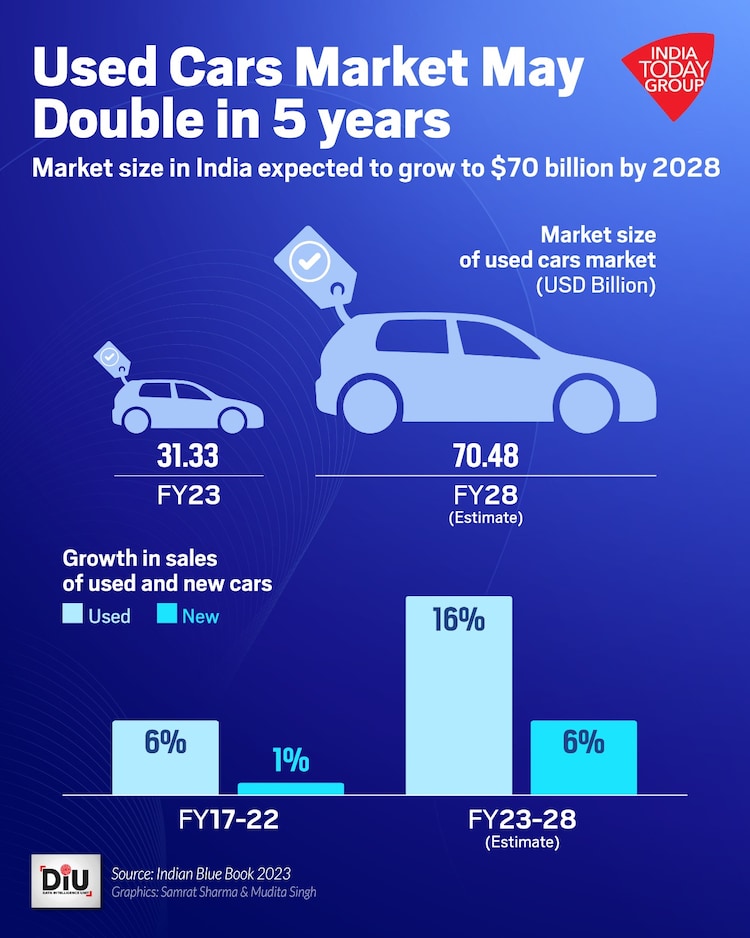

However, the growth rate of the used cars market is expected to significantly outgrow the sale of new cars in the next few years, which makes it a viable option for the government to tap this market in terms of taxation.

HOW BIG IS INDIA’S USED CAR MARKET?

According to the Indian Blue Book 2023 report by Das Welt Auto, a Volkswagen certified pre-owned car company, and Car&Bike: “India’s used car market is on the cusp of explosive growth, fuelled by a potent combination of factors. A burgeoning middle class with rising disposable income, coupled with a growing desire for personal mobility, is creating a perfect storm for the sector.”

The market size for used cars in India stood at USD 31.33 billion in 2022-23 but is expected to more than double to USD 70.48 billion by 2027-28. Also, the average growth rate for the used cars market between FY2017 and FY2022 was six per cent, which is expected to jump to 16 per cent between FY23 and FY28. In the same duration, the expected change in average growth of the new cars market is one per cent to six per cent.

USED CAR SALES

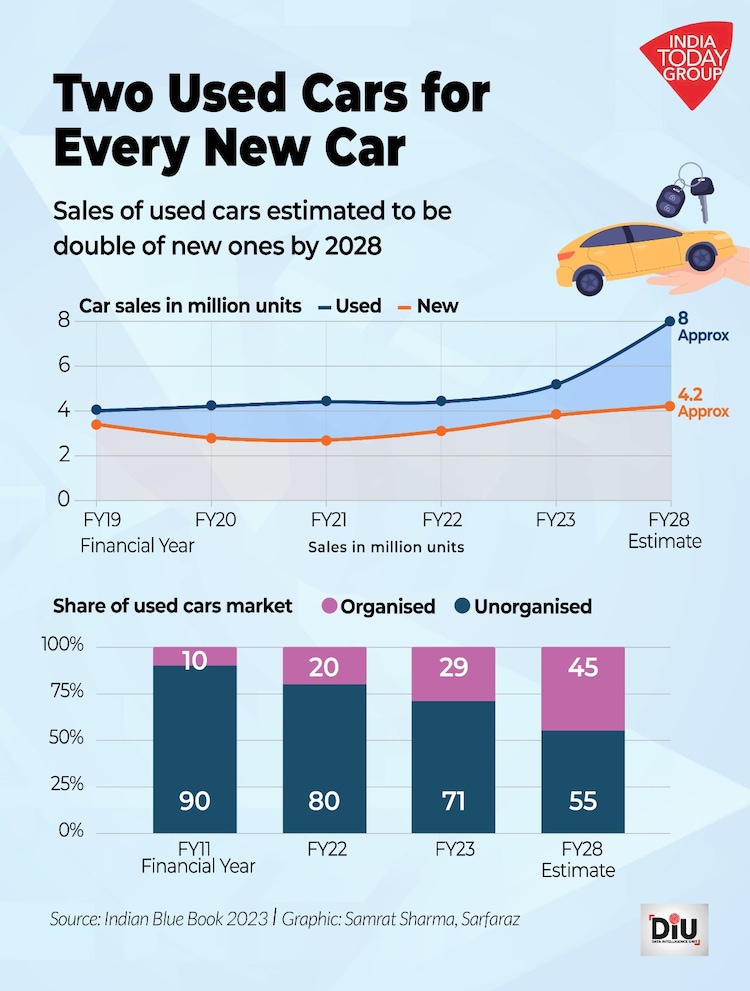

Higher disposable income, the need for mobility, and the increase in the organised sector in the used car market are boosting sales. From over five million units of used cars sold in FY23, the sales are expected to surpass eight million by FY28. This also means that the ratio of used cars to new cars, which is 1.4 at present, will increase to 1.9.

Various companies like Spinny and Cars24 have led to the expansion of the organised sector in the used cars market, pulling up consumer confidence. The organised sector in this market was only 10 per cent in FY11, which rose to 29 per cent in FY23 and is expected to grow to 45 per cent by FY28.

CHANGING LANDSCAPE OF THE USED CAR TRADE

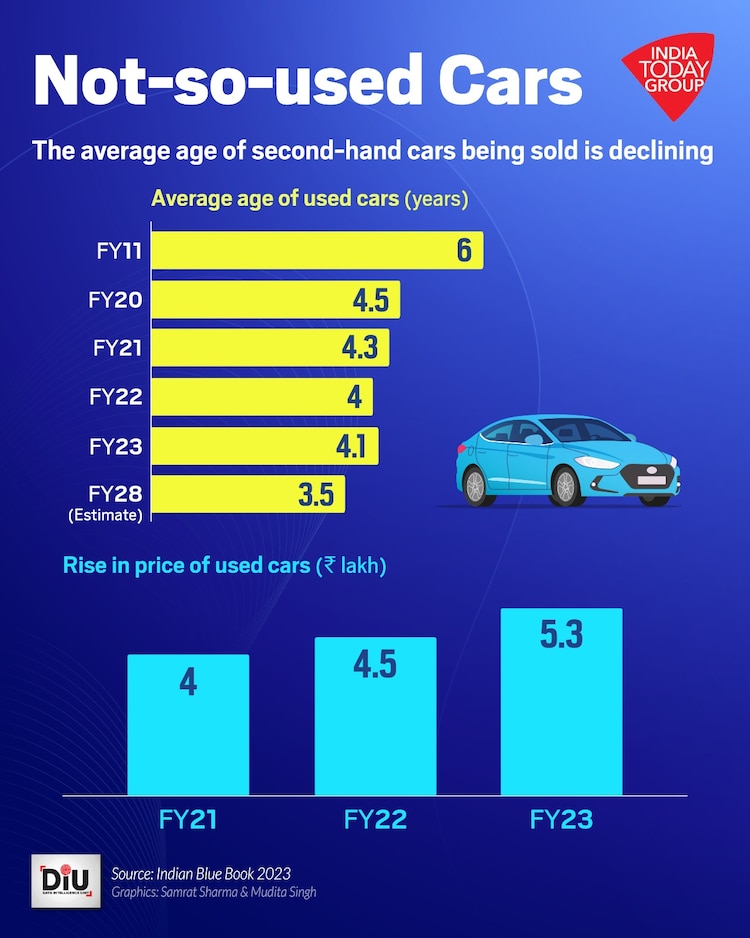

Car owners are replacing cars much faster than before. While this has improved the condition of used cars, it has also increased the cost for used car buyers. The average age of used cars in India was six years in FY11, which significantly fell to nearly four years now and is expected to further fall to only 3.5 years by FY28. Conversely, the average price of used cars rose from Rs 4 lakh in FY21 to Rs 5.3 lakh in FY23.

SHIFT IN REASONS TO SELL CARS

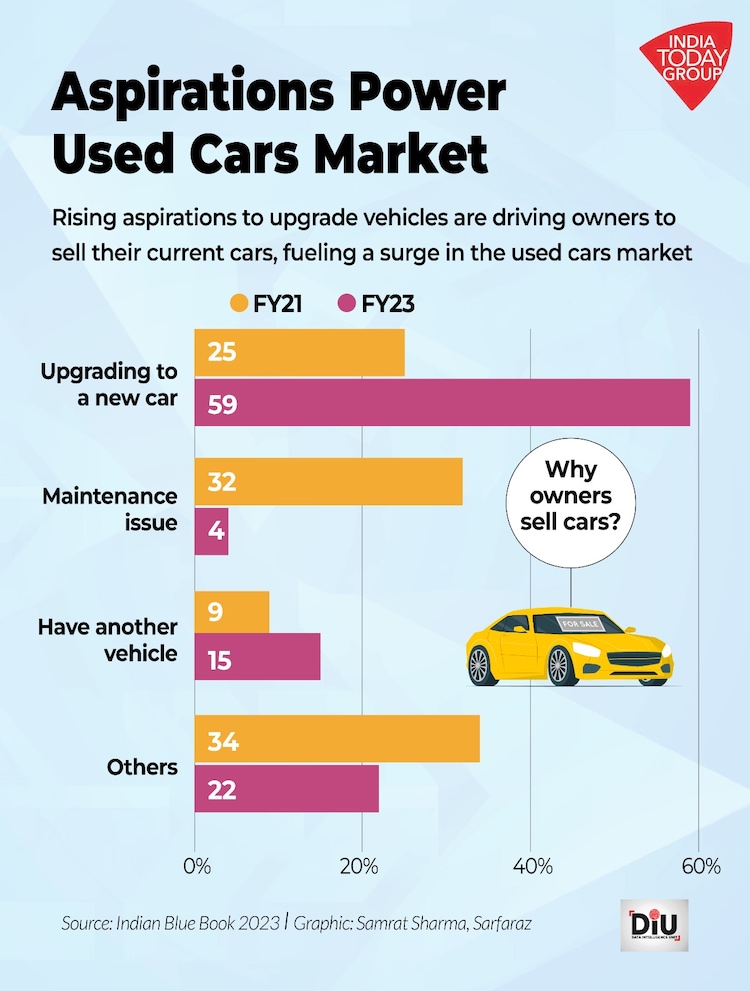

Earlier, a majority of car owners changed cars due to maintenance issues. But now, the desire to upgrade to a new car is on the rise. About 32 per cent of car owners sold cars due to maintenance issues in FY21, and only 25 per cent sold cars to upgrade to a new one. But in FY23, about 59 per cent of car owners sold the old car to upgrade to a new one, and only four per cent sold due to maintenance issues.

POTENTIAL IN INDIA’S CAR MARKET

India has a very low per capita car ownership. Against 150 cars per thousand people in China, 380 in Germany, 510 in the US, 360 in France and 340 in the UK, India has only 20 cars per thousand people, according to the IBB 2023 report. This highlights the potential of India’s car market, especially the used cars market, given the rise in the standard of living.