The common global platform strategy is nothing new. Carmakers have sought to cut development and construction costs by using the same kit of parts to build a range of different models for decades. However, with the EV revolution comes the chance to further hone development.

And that’s good news too – with battery prices still representing a significant chunk of the vehicle cost, finding other ways to trim expense is essential to keep EVs affordable and appealing to end consumers.

For our latest Top Five, we have been taking a look at five common global EV platforms from some of the world’s biggest carmakers. Each offers slightly different approaches, with differing takes on battery capacity requirements, motor provision and level of commonality, but one thing they do agree on is the significant up-front cost: the five profiled here represent an investment of at least $160bn – yes, billion dollars!

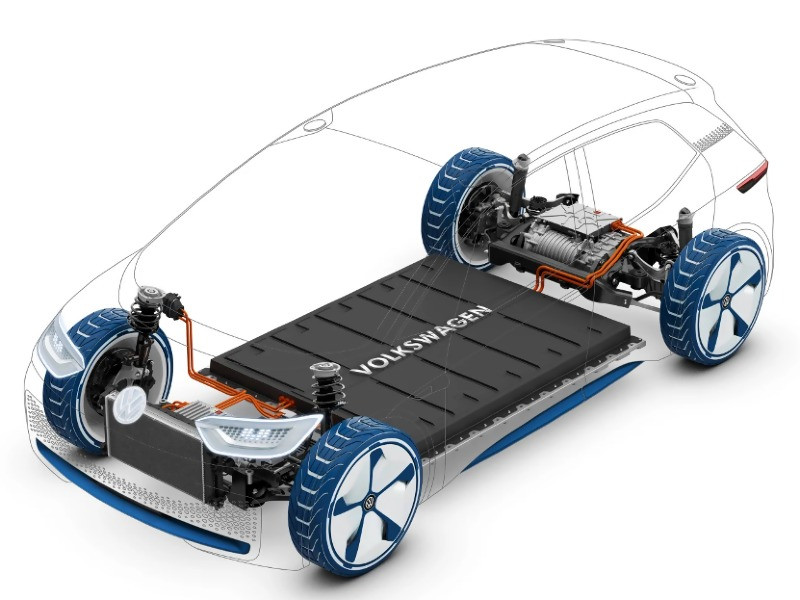

#1 – Volkswagen Group MEB

Production locations: Zwickau, Germany (2019); Shanghai, China (2020); Chattanooga, TN, US (2022)

Investment: Over €30bn by 2023

Example models: Volkswagen ID3 and ID4; Seat El Born; Audi Q4 e-tron; Skoda Enyaq

Estimated volume: 15 million vehicles by 2025

Battery sizes: 52kWh to 77kWh

Range: 205 to 342 miles

Charging capacity: 125kW

EMotor: Rear-drive first; twin motor all-wheel drive to follow

VW’s answer to the transition from ICE to EV is its MEB platform. Set to underpin a host of models from the Group’s brands, MEB is short for Modularer E-Antriebs-Baukasten, which translates from German into English as modular electric drive matrix.

The platform has received huge investment from the VW Group, with the first car – the VW ID3 – now beginning to make its way from production and into dealers. In addition to being used across the Group, the platform is up for sale, with Ford signing on for 600,000 to underpin a European-market SUV, due to launch in 2023.

#2 – GM Global EV Platform

Production locations: Detroit-Hamtramck, MI, USA (2021); Multiple locations in China

Investment: $20bn by 2025

Example models: Cruise Origin; Cadillac Lyriq; GMC Hummer

Estimated volume: 1 million per year in the US and China by 2025

Battery sizes: 50kWh to 200 kWh

Range: Up to 400 miles

Charging capacity: Up to 200kW

EMotor: front, real and all-wheel drive versions possible

GM just beat coronavirus to the punch by unveiling its new global EV platform on March 4 at a special media day, held in its Design Dome in Warren, MI.

Presented by GM CEO Mary Barra, the GM Global EV platform features high levels of configurability built in, thanks to the firm’s LG Chem-sourced pouch cell Ultium batteries that allow for more flexibility of formats. The cells also drive down cost, with GM claiming less than $100/kWh.

Its EVs will use GM-developed motors, feature DC fast charging capability, and Super Cruise ADAS as standard. The first drivable vehicle using the platform will be the Cadillac Lyriq SUV, and – like VW – GM has announced that Honda will design and built two EVs using GM’s EV platform.

#3 – Toyota Electric New Generation Architecture e-TNGA

Production locations: Tianjin, China with FAW

Investment: $13bn by 2030

Example models: Toyota C-HR; Lexus UX300e

Estimated volume: 1 million per year by 2025

Battery sizes: Three available, 54.3kWh confirmed with up to 100kWh coming

Range: 186 to 372 miles

Charging capacity: 50kW announced so far

EMotor: front, rear and all-wheel drive versions possible

Toyota originally planned to sell one million zero-emission vehicles per year by 2030. However, it revised that in 2019 to achieve EV and FCEV sales volumes of a millions units by 2025, focusing first on the Chinese market and rolling out from there. Key to this is the TNGA architecture that rolled out under the latest Prius, and is fully electrified first in the Toyota C-HR, first shown at the 2019 Shanghai Motor Show.

Designed in collaboration with Subaru, the e-TNGA EV Platform is flexible enough to accommodate a host of different vehicle types and drive options. These include three different wheelbase lengths, three different battery sizes and three different power outputs. Toyota has stated that it will offer an initial 10 models globally by 2025.

#4 – Renault-Nissan-Mitsubishi CMF-EV

Production locations: Flins, France; Smyrna, TN, US; Sunderland, UK; Oppama, Japan

Investment: Over $10bn by 2022

Example models: Renault Morphoz concept (above); Nissan Ariya concept

Estimated volume: 1 million per year by 2022

Battery sizes: 40kWh to 90kWh

Range: 249 miles to 435 miles

Charging capacity: TBC

EMotor: front and all-wheel drive versions possible

The Common Module Family platform is already in use under ICE-powered cars like the Nissan Qashqai and Renault Megane. However, the EV version is on the way this year. First hinted at by the 2019 Tokyo Motor Show arrival of the Nissan Ariya, a concept built on an undisclosed EV platform with a twin-motor drivetrain, the Renault Morphoz concept officially debuted the CMF-EV architecture earlier in 2020.

The concept was intended to debut at the Geneva Motor Show, but got an online release instead as the event was cancelled due to Covid-19. The Morphoz is a shape-shifting showcase designed to highlight the flexibility of the platform. At least 12 models built on CMF-EV are on their way in the next two years.

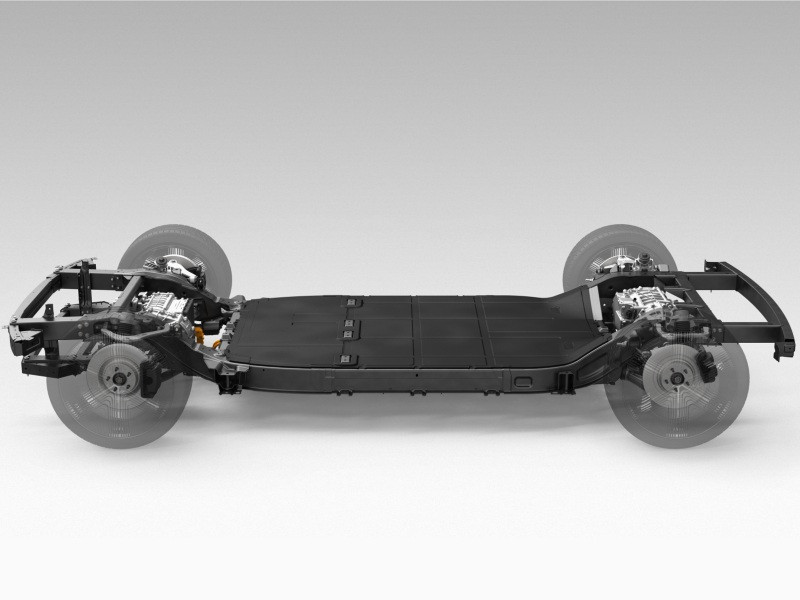

#5 – Hyundai-Kia E-GMP Global EV Platform

Production locations: Multiple undisclosed

Investment: $87bn by 2025

Example models: Hyundai 45 and Prophecy; Kia Imagine

Estimated volume: Hyundai 560,000 per year by 2025; Kia 500,000 per year by 2026

Battery sizes: 58kWh to 73kWh

Range: 218 to 311 miles

Charging capacity: Up to 200kW

EMotor: front and all-wheel drive versions possible

Hyundai-Kia is taking EVs extremely seriously, announcing a huge $87bn will be spent by 2025 – including Hyundai’s plan to invest $52bn in future technologies through 2025, while Kia will invest $25bn in electrification and future mobility technologies, aiming for eco-friendly vehicles to comprise 25 per cent of its total sales by 2025.

Right now, the firms have a joint Eco-Car platform that underpins the Hyundai Ioniq and Next, and the Kia Niro, while the Hyundai Kona and Kia Soul Electric use the small-car platform. However, the firms will move to the E-GMP, beginning with the Hyundai 45 later this year, while the next-generation Ioniq is due in 2021, previewed by the Prophecy concept. A Kia sedan, previewed by the Imagine concept, is due in 2021 too. Unlike some rivals, E-GMP uses Porsche Taycan-esque 800V technology.

In addition to going it alone, Hyundai and Kia are spreading their investments to increase EV knowledge quickly. The firms have invested an undisclosed amount in US start-up Canoo in order to develop a bespoke, flexible EV platform for a range of smaller cars, while a further $110m has been spent partnering with UK-based Arrival for commercial EVs.